April is National Financial Capability Month

National Financial Capability Month is dedicated to raising awareness about the importance of financial education in the United States and the serious consequences associated with a lack of understanding about personal finances. A 2022 survey from Greenlight found that 93% of teens believe they need financial knowledge and skills to achieve their goals however, they still score an average of only 64% on the National Financial Literacy Test. There’s clearly a disconnect, which is all the more reason to empower high school students with the financial education and tools they need before they have to make financial decisions on their own. It’s the old adage, “They don’t know what they don’t know.”

Financial knowledge breaks down barriers and provides teens with a solid foundation on which to build a healthy and financially secure life. One way high schools do this is by hosting reality or career events. These large-scale events provide teens with interactive experiences for making real-world financial decisions and managing money. The scene is familiar, several stations set up around the gym, students milling about bouncing from booth to booth to learn about credit cards, budgeting for everyday expenses, setting up a bank account, career choices, college costs, etc.

The exposure to these important concepts is eye-opening for students, but is there more we can do? Do we want students to go further and understand how the decisions they make today affect their lifelong goals? What if there was a way to double the impact of a career/reality event by adding an additional tool that personalizes their decisions about life after graduation and helps them put financial skills into practice? Would it be nice to provide students with a tool that they can take with them after the event and have access to for life? That’s what Money Path, the most complete academic career and financial planning app for teens can do. Available at no cost to Wisconsin high schools, the Money Path app is an innovative web-based app that enhances high school curriculum in three ways: in a personal finance class, within academic and career planning activities with counselors, and in large group or multi-grade career readiness and personal financial planning activities, like a career or reality day.

Money Path as a large group activity

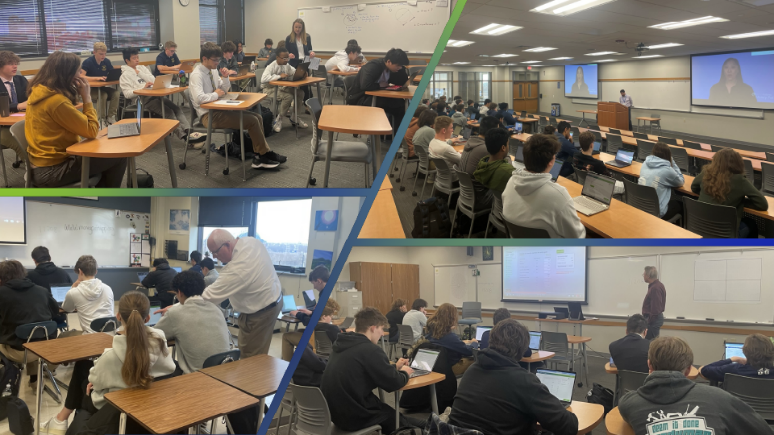

That’s exactly what Marquette University High School recently did when they hosted their 5th annual Money Path day for 200 juniors in 12 classrooms. Principal Jeff Monday keeps bringing Money Path back year after year because of the value he sees in it. “Financial literacy is so important in preparing students for college and life beyond and the Money Path app has presented so many opportunities and has opened students’ eyes to understand what they need to consider as they plan for their future. We’ve been so grateful to SecureFutures for making available the volunteers and the Money Path app that has really served our students so well and has given them a sense of direction for their futures.”

In the app, students learn about career paths, and post-high school education costs, and experience real-life financial planning. They explore their post-graduation goals and assess the potential long-term financial impacts of choices they’ll be making in the coming months and years. Money Path helps students start the conversation to think past today and into their futures.

The easy-to-use interface is simple for educators and career and academic advisors to use in a large group format. In fact, Money Path is so intuitive that demonstrations are easily facilitated by staff who may not be experienced in teaching personal finance or academic and career planning. A guided facilitation video is provided along with the app and walks students step-by-step through creating an account and setting up a path, allowing educators and academic advisors to do minimal prep work and focus more on the students, their personalized paths, and reflection questions.

See the impact of Money Path

Sounds great! But where’s the proof it works? Take a look at the latest student behavioral changes:

95% are more likely to set up a savings plan for important financial goals like an emergency fund, car, or home once they start their career

89% reported they are more likely to determine what student loan amount is manageable

84% increased their knowledge of how income, spending, and saving are all connected in their financial plan

These stats are only part of the story because the Money Path app can be used throughout a student’s high school experience and beyond, with the ability to revisit and adapt their plans as they transition into adulthood. Financial capability is vital to empowering individuals and families to make informed decisions about their money, plan for their financial future, and achieve their financial goals. Something everyone deserves. To learn more about how to use Money Path for large group activities click here and get one step closer to helping students build better financial futures.

Contact the SecureFutures team to find out how to bring Money Path to your students today, or visit securefutures.org/money-path. Learn more here or request a Money Path demonstration here.