Remember those “Choose Your Own Adventure” books where you were the protagonist in the story and got to choose what turns the book would take and how it would end?

As advisors and educators, you are steering students through their own real-life Choose Your Own Adventure book. In doing so, you’re playing a vital role in teaching them about the return on investment (ROI) of their post-high school decisions.

Defining “Return On Investment”

ROI isn’t just finance jargon – it’s a guiding principle for decision-making. It can be thought of as a scale, weighing what you put in against what you get out. In life, it’s about evaluating the choices you make and understanding the potential returns – whether they’re financial, personal, or professional.

Weighing options: Education, career, and beyond

As teens step into the post-high school world, there are options aplenty. Higher education, apprenticeships, military, or entering the workforce directly. Each choice is an investment and students should consider not just the immediate gains, but the long-term outcomes of their decisions. Higher education is often thought of as a hallmark of investment in oneself, but it’s not for everyone. According to the Education Data Initiative, the average federal student loan debt balance in 2023 is $37,718. While this is a scary-sounding number, it shouldn’t serve as an immediate deterrent to attending college. Students should be encouraged to consider the cost vs. the potential earnings, the skills gained, and the doors that could open with a degree.

It’s important for students to align their interests with promising career paths, but for some, thinking beyond traditional education may be the right choice. Consider the fact that companies like Google, Apple, IBM, Dell, and General Motors no longer require applicants to have college degrees for several of their positions. And, according to the World Economic Forum’s 2023 Future Of Jobs Report, the current skills gap is so big that nearly half (44%) of individual workers need to be upskilled to do their jobs effectively. Apprenticeships, internships, and military service offer direct skill development and faster entry into the workforce. These avenues provide immediate ROI by focusing on practical skills that translate into job opportunities.

Determining if college is the right path

While college may not be the right choice for everyone, it can be incredibly beneficial for some. In answering the question of whether college is “worth it”, bestcolleges.com offers this helpful list of pros and cons of earning a Bachelor’s Degree:

Pros

- Increased earnings – a 25% wage premium

- Career flexibility – more opportunities to climb the ladder

- Advanced degree options

- Alumni networks – useful for job hunting and career advancement

- Enhanced critical thinking and problem-solving skills

- Breadth of knowledge across fields, in addition to depth in chosen area of study

- Self-awareness of personal strengths and career goals

- Opportunities to pursue a passion, create a better life, or discover your purpose

Cons

- Cost – about $140,000 over four years, on average

- Student loan debt

- Opportunity cost, or potential lost earnings from not working

- Unnecessary for many jobs, including some government and tech positions

- Some fields offer poor ROI

- Curriculum can’t keep pace with the evolution of jobs, which may result in poor preparation for the job market

ROI isn’t just about money. While the decision to attend a college or university after high school involves weighing the pros and cons, ultimately the worth of a degree hinges on a teen’s individual aspirations, the field of study they’re interested in, and what their personal and professional goals are.

Personal development and non-monetary ROI

Pursuing passions that bring personal satisfaction holds significant value. Investing in personal growth and fulfillment contributes to happiness and overall well-being – an invaluable return in itself. If going to college causes a student to take on a lot of student loan debt, they may find themselves sacrificing a more fulfilling job for a career with a higher salary. On the other hand, college brings with it exposure to diverse ideas and networks, and the opportunity for self-discovery that students may not get otherwise. Helping students determine what path makes sense based on what they envision for their future and whether it’s a realistic goal can be daunting. That’s where the Money Path app comes in.

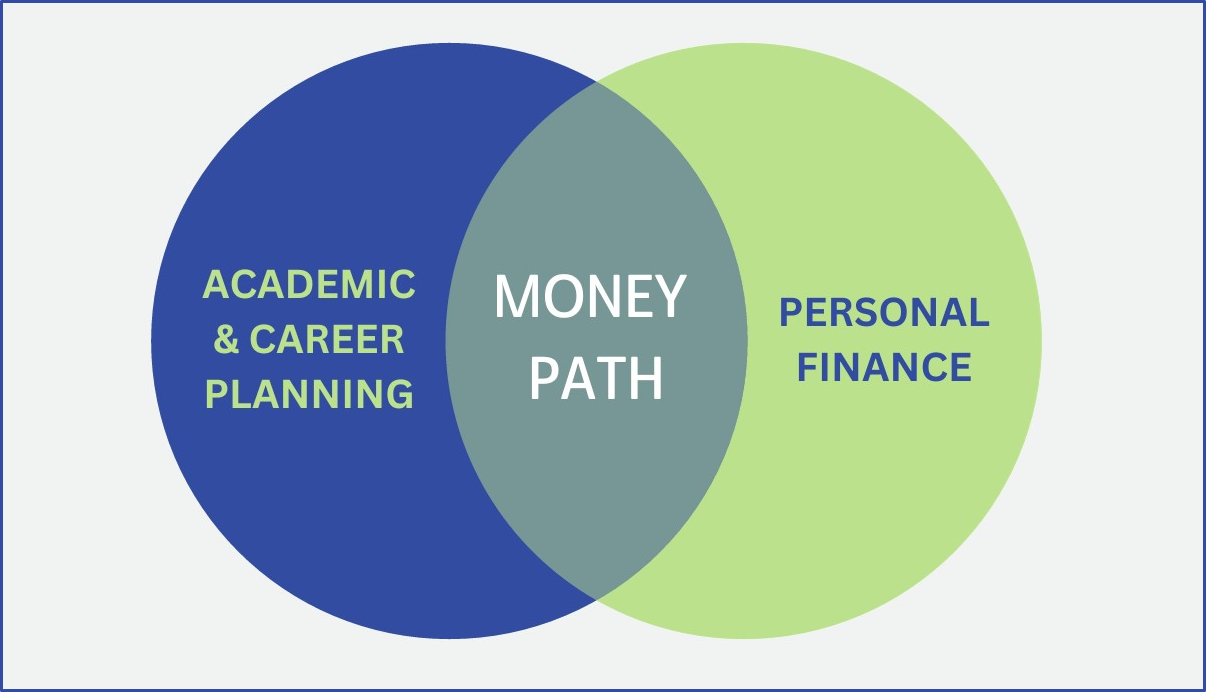

Facilitating informed decisions by uniting ACP with Personal Finance

Money Path acts as a compass in each student’s individual adventure, blending academic and career planning with personal finance. By doing so it provides a great opportunity for ACP and personal finance departments to connect and work together, linking curriculums in a way that may not have been thought of before. It’s also an opportunity for students to utilize the tool in different classes so it’s something they’re using more than once.

With Money Path, students can:

- Explore different paths after graduation

- Investigate the cost of higher education and plan how to manage student debt

- Customize a monthly budget based on their career starting salary

- Learn creative ways to save for important financial goals like an emergency fund, a home, or retirement

- Compare different personalized paths side by side

- Make decisions for their future with confidence

Help students start their adventure today

Much like those Choose Your Own Adventure books, Money Path isn’t a predetermined route, it’s a narrative waiting for students’ personal touch. To equip students with the means to shape their narratives confidently and determine the ROI of their decisions, schedule a call today. To learn more about the power of this free tool that unites academic, career, and financial planning, click here.